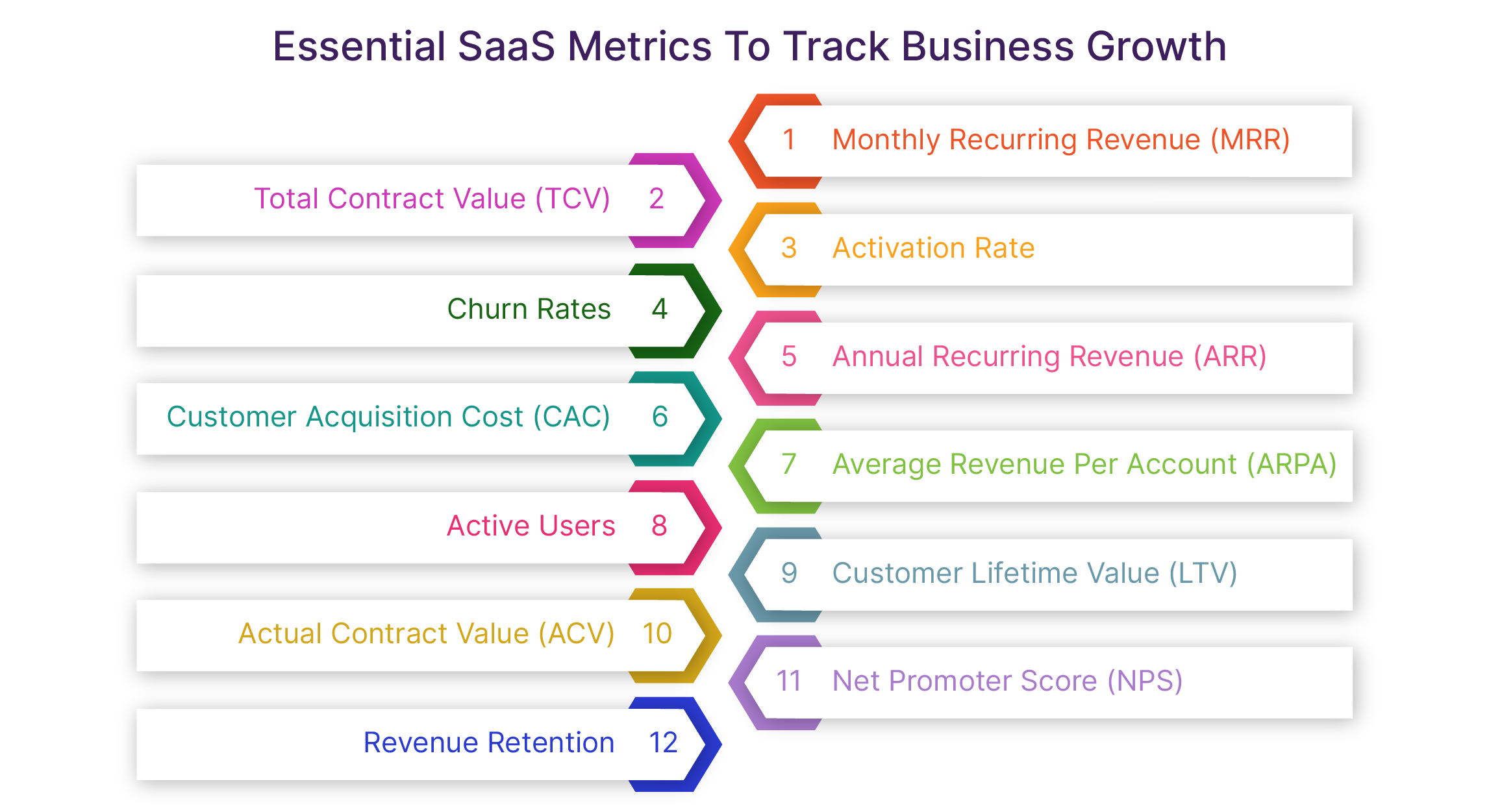

As a SaaS product owner, it’s important to track the right metrics to measure the success of your product. In this blog post, we’ll discuss the 12 most essential SaaS metrics for product owners to track, and explain how to use them to improve your product and business.

Overview of SaaS Metrics

Most Software-as-a-Service (SaaS) businesses rely on a monthly or yearly subscription charge to offer their products or services to customers. This subscription-based approach is crucial for the sustained growth of these businesses in the long run. Unlike traditional business models, SaaS businesses are not solely focused on targeting customers for one-time purchases. Instead, they prioritize the continuous acquisition of new customers and the retention of existing ones to ensure long-term business growth. Thankfully, by tracking and analyzing key SaaS metrics, you can effectively measure all aspects of your business growth, enhance your sales strategies, and improve your marketing tactics.

SaaS metrics are crucial for SaaS business owners to track and improve their business growth and performance. Understanding and evaluating different SaaS metrics can help owners or founders of SaaS companies achieve their business objectives. Some organizations also use SaaS analytics software integrations to measure important business and financial aspects. By knowing the essential SaaS KPIs, enterprises can stand out from competitors, including those offering on-premise software to customers.

12 Key SaaS Metrics for Monitoring Business Growth

Evaluating SaaS metrics is crucial for businesses of all sizes, from micro-SaaS to large-scale companies like Slack and Shopify. By leveraging different valuation metrics, you can track the right business parameters and gain insights into overall performance. Analyzing revenue generated in a defined time period and customer data can help you make wise decisions and improve future planning and strategies. Here are some essential SaaS metrics to consider for achieving business growth.

MRR – Monthly Recurring Revenue

Monthly Recurring Revenue (MRR) serves as a vital metric in the realm of Software-as-a-Service (SaaS), enabling companies to ascertain the revenue generated within a month. This revenue can originate from either new sales or existing customers. It is worth noting that multiplying MRR by 12 yields the Annual Recurring Revenue (ARR).

By computing the MRR of your SaaS product, you can effectively establish a pricing strategy that aligns with market demands and guarantees the provision of high-quality services to customers, thereby fostering consistent growth. MRR plays a pivotal role in preventing the undervaluation of your services and provides insights into the trajectory of your business’s expansion.

=> MRR Monthly Recurring Revenue = Total revenue received per month

TCV – Total Contract Value

When evaluating the Total Contract Value (TCV), it is important to consider that it encompasses various components such as one-time subscriptions, professional service fees, add-ons, and contract renewal charges. This metric enables SaaS product owners to assess the value that customers bring to their business through contractual agreements. TCV serves as a valuable tool in accurately estimating revenue, identifying valuable customers, and improving sales strategies among the essential SaaS Key Performance Indicators (KPIs).

=> TCV Total Contract Value = Monthly Recurring Revenue (MRR) X Contract Term Length (in months) + Contract Fees (including professional services, one-time charge, etc.)

Activation Rate

Many businesses view the Activation Rate SaaS metrics as a straightforward method for assessing the effectiveness of a product. This metric reveals the steps a customer takes to fully understand the value or critical event associated with a product or service.

For instance, in the case of a ride-sharing application, activation occurs when a user successfully books and pays for their first ride. Only after this primary event is triggered will the user begin to experience the true value of the application. By utilizing the Activation Rate, businesses can gain insights into how different users engage with the product and the specific actions they take within it. Consequently, businesses can expedite the process of users uncovering the value of a product.

=> Activation Rate = Number of users to successfully trigger the critical event / Total number of users

Churn Rates

Churn Rates, a widely used metric in SaaS marketing, are essential for measuring both loss and growth. Whether you aim to assess customer recurrence, contract attrition, GAAP revenue, or Monthly Recurring Revenue (MRR), calculating Churn Rates can provide valuable insights. It is important to note that Churn Rates can be expressed as either a ratio or a rate, and occasionally as numerical values.

SaaS businesses may have diverse churn SaaS metrics depending on their specific objectives and desired outcomes. However, it is still advantageous to explore some commonly encountered churn SaaS metrics. Here are a few prevalent churn types that you should familiarize yourself with:

- Churn of Customers

Customer Churn refers to the loss of customers over a period of time. It is also known as customer attrition or defection. Monitoring the Customer Churn rate is crucial to identify any necessary changes in the business strategy. If the percentage of Customer Churn decreases, it indicates the need to focus on customer retention and acquisition or re-evaluate the marketing plan. SaaS companies typically report a Customer Churn rate of 5-7%, which means losing seven out of 100 new customers.

- Revenue Churn

Revenue Churn is a metric that measures the loss of revenue over a specific period, similar to Customer Churn. To calculate the Revenue Churn rate, subtract the revenue generated by new customers in the current and previous quarters from the total revenue. For example, if your business earned $5000 in the first quarter and $4000 in the next quarter, the Revenue Churn rate can be calculated as follows:

=> $5000 – $4000/5000 = 2% Revenue Churn Rate

- Churn of Recurring Revenue

To determine the lost percentage of Monthly Recurring Revenue (MRR), you can use Recurring Revenue Churn. This allows you to calculate the lost MRR for customers who have canceled or downgraded. For instance, if a SaaS business has a recurring revenue of $50000 and experiences a loss of $5000 from churned customers, the Recurring Revenue Churn rate would be 10 percent.

ARR – Annual Recurring Revenue

ARR is a crucial SaaS marketing metric that enables product owners to estimate the revenue their business can generate from customers annually. It is the most effective KPI for measuring and projecting financial growth year after year. ARR empowers SaaS companies to evaluate their financial performance and make informed decisions regarding budgeting, resource allocation, and growth strategies.

By using ARR, businesses can identify opportunities to optimize revenue generation. To calculate ARR, simply multiply your current monthly recurring revenue (MRR) by 12.

=> ARR Annual Recurring Revenue = Monthly Recurring Revenue (MRR) x 12

CAC – Customer Acquisition Cost

The main objective of an online business is to convert visitors into paying customers. However, achieving this goal requires significant efforts, strategy, and a considerable amount of money. The money invested in converting potential customers into actual customers through the sales process is known as Customer Acquisition Cost.

CAC is one of the most expensive costs in SaaS businesses, and monitoring it can help determine if the investment in acquiring new customers is worthwhile. SaaS business owners can use Customer Acquisition Cost (CAC) along with Customer Lifetime Value (CLV) SaaS metrics to ensure the feasibility of their business model.

Let our SaaS development team assist you in enhancing and optimizing your products and services to address evolving consumer demands.

ARPA – Average Revenue Per Account

Every customer is important in SaaS business because they pay a set fee to use your business’s services or products. To determine the revenue generated from each customer or account, Average Revenue Per Account (ARPA) is a useful metric for SaaS companies. ARPA can be calculated on a monthly, quarterly, or yearly basis depending on the needs. Calculating ARPA is straightforward – divide the Monthly Recurring Revenue (MRR) at the end of each month by the total number of customers (both new and existing) in that month.

=> ARPA Average Revenue Per Account = Monthly Recurring Revenue (MRR) / Total number of active customers

SaaS product owners need to calculate the Average Revenue Per Account (ARPA) or Average Revenue Per User (ARPU) for new and existing customers. This helps assess the growth of ARPA and understand customer behavior, enabling the provision of satisfactory services.

Active Users

Active Users are essential for evaluating various aspects of your SaaS product or business, such as improving user experience, enhancing the interface, ensuring smooth operations, and tracking business growth. However, it is important to understand the definition of Active Users.

Active Users refer to those who engage with the core functionality of your SaaS product or service. In the case of an e-commerce app, Active Users are those who complete a transaction after making a purchase. If you notice a gradual decline in Active Users for your SaaS business, making changes to the user interface, simplifying accessibility, integrating OpenAI in SaaS, or optimizing marketing techniques may be beneficial. Regularly monitoring the number of Active Users on a daily or weekly basis also helps in attracting the right customers.

LTV – Customer Lifetime Value

Customer Lifetime Value (CLV), also known as Lifetime Value (LTV), is the total value that a customer adds to a SaaS product or business throughout their relationship. It encompasses the amount of money a user spends on the service from the beginning to the end of their contract.

CLV is a crucial metric for SaaS companies as it provides insights into the value and growth of your customers over time. It is also beneficial for investors to assess the worth of your company’s products and services. In a subscription-based SaaS model, a customer’s lifetime value continues to increase with each renewal until they decide not to renew their subscription. The calculation of CLV is as follows:

=> CLV Customer Lifetime Value = Customer Lifetime Rate (CLR = 1 / MRR) x Average Revenue Per Account (ARPA)

ACV – Actual Contract Value

Knowing the annual payment from a customer is crucial to determine their worth. Actual Contract Value (ACV) is a significant SaaS Key Performance Indicator (KPI) that measures the average value of a customer’s subscription in a year. ACV and ARR are vital for SaaS startups as they can contribute to their success.

In addition to evaluating sales and marketing strategies, ACV helps prioritize efforts and resources for profitable assets. The formula to calculate ACV is as follows:

=> ACV Actual Contract Value = Value of contract / Length of contract (in years)

Calculating ACV for multiple customers can be challenging. But we can simplify it for you with the following example:

- Customers A, B, and C pay $500, $1000, and $1500 subscription fees for one, two, and three years correspondingly.

- The initial calculation of the ACV for the first year involves the inclusion of all three customers, namely ($500 + $1000 + $1500) / 3 = $1000.

- The average ACV for two customers for the second year will amount to $1250, calculated as ($1000 + $1500) / 2.

- The ACV for the third year will be $1500 for a single customer.

NPS – Net Promoter Score

Every business focuses on customer satisfaction and experience. Net Promoter Score (NPS) helps measure customer satisfaction and loyalty towards your brand or product. This metric determines if customers are happy with your SaaS product. If they are unhappy, they won’t recommend your product or services.

To gauge customer satisfaction, businesses ask customers to fill out surveys or rate the likelihood of recommending their products or services. This helps determine the customer satisfaction rate. If customers are unsatisfied, you can ask for feedback to improve their experience and regain their loyalty. The Net Promoter Score is calculated by subtracting the percentage of dissatisfied customers from the percentage of satisfied customers.

Revenue Retention

When you come across the term Revenue Retention, it implies the act of keeping customer revenue for a prolonged period. Revenue Retention signifies the money you manage to retain despite losing customers, which helps sustain your business. There are two SaaS metrics for Revenue Retention: Net Revenue Retention (NRR) and Gross Revenue Retention (GRR).

- Net Revenue Retention (NRR): NRR measures the overall change in recurring revenue within a specific time frame, focusing on a defined group of customers. NRR serves as a health indicator to assess if your product is suitable for the market.

=> NRR Net Revenue Retention = Current MRR from a defined customer group / MRR of the same customer group 1 year ago

- Gross Revenue Retention (GRR) indicates the ability to retain customers and is either equal to or lower than NRR. GRR does not take into account factors such as price increases, up-selling, or organic customer growth.

=> Gross Revenue Retention (GRR) = Current MRR from a defined customer group – (upsells, increased price, or organic growth) / MRR of the same customer group 1 year ago

In conclusion,

Understanding the importance of tracking the right SaaS metrics is crucial for informed decision-making and overall business growth. By reviewing the top 12 SaaS metrics, you can customize these KPIs to analyze various performance aspects and pinpoint areas for improvement. Tracking these SaaS metrics can guide your business towards success.

Leave a Reply